Is the 4% rule a myth?

The 4% rule has long been revered as the cornerstone of retirement planning. But with changing times, is this rule still relevant? If you’ve been striving to decipher your “magic number” that promises financial independence, you’ve likely encountered the 4% withdrawal rule. But what does it truly signify? And more importantly, should you heed it or discard it? Let’s explore.

Let’s start with what this rule is about

The 4 percent rule is a rule of thumb used to determine how much a retiree should withdraw from a retirement account each year. This rule seeks to provide a steady income stream to the retiree while also maintaining an account balance that keeps income flowing through retirement. Experts consider the 4 percent withdrawal rate safe, as the withdrawals will consist primarily of interest and dividends.

Investopedia

Understanding the 4% Rule

The 4% rule is a guideline for retirement. Imagine that you have a big pile of money saved up, and you’re ready to stop working and live off this money for the rest of your life. The question is: how much of that money can you spend each year, so you don’t run out?

That’s where the 4% rule comes in. It suggests that in the first year of your retirement, you withdraw 4% of your total savings. For example, if you have $1,000,000 saved, you would take out $40,000 to live on for the first year.

Then, each following year, you take out the same amount, adjusted a bit for inflation. So if inflation is 2%, the next year you would take out $40,800.

The rule is based on historical financial market performance and assumes that your savings are invested in a mix of stocks and bonds. The idea is that even though you are spending some of your money, the rest of your savings continue to grow, and this growth helps your money last for a long time – ideally, the rest of your life.

The Downside of the 4% Rule: Why It Might Not Work?

Despite its popularity, the 4% rule has certain drawbacks. Let’s discuss two of those here:

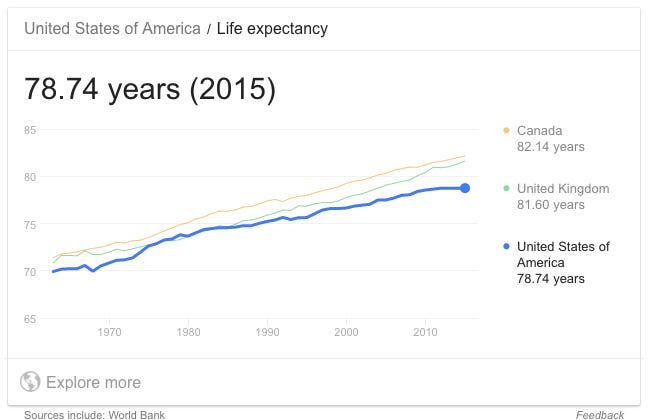

Longevity: In most cases, this rule assumes a retirement life of 30 years which may have been true for earlier generations but Gen-Y and millennials are planning to retire early and they are healthier and will live longer than their parents as shown in the chart below

Market Volatility: The 4% Rule ignores market volatility i.e. one big dip in markets or a recession can derail your entire plan. Keep in mind the big drop in the portfolio requires even bigger gains to just break even. Assume a $10,000 portfolio gets hit by 50% decline to $5,000. This portfolio will need a 100% gain to be back to $10,000 and it can take years to just recover from a step loss. I think it would be sheer stupidity to assume markets will continue to rise and ignore recessions from your financial planning.

Charting Your Path: Alternatives to the 4% Rule

So you understand the 4% rule will probably not work if you are planning to retire early. The next obvious question – What can you do instead? Let’s walk through a bunch of scenarios that you can think about and choose from:

Setup a target number that is high enough

to sustain the worst market crash that you anticipate (in my case I assume 50%)

Keep pace with inflation, to say the least, better can grow 2-3% above inflation

Can support you forever (in case you live longer than the average American). You don’t want to run out of money when you need it the most.

For this reason, I prefer to think of perpetuity – it can support me forever. After me, my heirs can get a lump sum amount of money. If you don’t get the idea don’t worry, I will write a follow-up post on this topic and walk you through my personal calculations

Setup a passive stream of income

Semi-Retire: follow your dream or reduce working hours

Accumulate a certain amount of money which can enable you to say no to your boss. I call it FU money

Reduce your working hours, start freelancing, or take the risk and follow your dreams.

Say bye to your dream of retiring early. I don’t prefer this but sometimes, it’s the best option.

I am passionately working towards setting up multiple passive streams of income so I can retire early.

Share your thoughts in the comments.!!

The post Is the 4% rule a myth? appeared first on One More Million.