Don’t Cut Your Credit Card Before You Read This

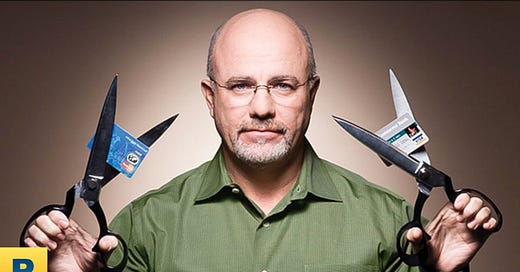

Should I use a credit card or not? A lot of finance gurus including Dave Ramsey tell you – Use hard, cold cash for all your purchases. This might be true for many but I don’t agree with this statement.

Before I start defending my arguments against Dave (virtually) I want to lay the fact I respect Dave and many other finance gurus as they have helped many of us get on the right path of financial independence. If you are in debt his simple yet effective 7 Baby Steps and Debt Snowball are a great way to pull yourself out of the debt hell.

Dave Ramsey makes a lot of points about the use of credit card and while he is right about a lot of things this may not be applicable to all users. As TPG points out, Dave uses harsh words when it comes to credit card debt:

“There’s no good reason at all to have a credit card”

“Responsible use of a credit card really doesn’t exist”

“When credit cards stay out of your wallet, money stays in!”

“There’s no positive side to credit card use. Even if you pay the bill on time, you’re not beating the system

Rumor has it – Dave also carries scissors around in the events to cut up the credit cards. He also recommends you assign every dollar of your income to its purpose for e.g. Mortgage, Food, Gas, Insurance, etc. It is also worth noting that Dave doesn’t accept credit cards on his own website (debit cards are accepted though).

Pitfalls and Benefits of Using Credit Card

There is an old saying “With freedom comes responsibility” and this applies to credit cards and for that matter any sort of plastic money. If you are not careful with the use of your cards you can be sucked into the debt hell.

Resisting the urge to buy something that you just saw is the key to the responsible use of credit cards. We all have seen many commercials trying to convince the audience that they will save money by buying stuff (I laugh when I hear this.

You can’t save money by spending or buying consumables. The only way to save money is to invest it. Invest in assets that will generate more money for you.

Benefits of Using Credit Card

There are a lot of benefits to using a credit or debit card but they do come at a cost. So what are the benefits?

Cashback – A lot of cards provide cashback like Citi Costco Visa Card. This year after moving back from Thailand we renovated our house and I got over $500 in cashback as we bought almost all our furniture from Costco using my Citi Costco Visa Card.

Some cards like Fidelity Visa deposit the cashback to your account every month. These are real Hard Cash dollarsReward Points and Free Travel – You can earn reward points which can be used for travel. I used my Chase Sapphire Reserve card when we were living in Thailand as I never (almost) had to carry cash or convert foreign exchange and earned 3% cashback on our travel and food expenses. The end result we bought 4 business class tickets for FREE for the family to come back home (Seattle). This card is canceled now as we don’t travel as much

Build Credit History – Wise usage of the card helps you build your credit history and helps you get better interest rates when the time comes to get a mortgage. Most of the credit unions like if you have a good mix of credit accounts.

Interest-FREE Credit – You pay much after you buy. If paid on time and the full amount you enjoy interest-FREE (0% interest) credit from the bank.

Pitfalls of Using Credit Cards

I can’t emphasize enough on – Don’t buy something just because you are getting a cashback or will earn miles or Don’t buy something just because you want it or your friends have it.

Acknowledge the difference between needs and wants. Controlling the urge to buy something at first sight. These habits are good building blocks for financial freedom.

Key Things to Avoid when using credit cards:

Not Paying credit card bill in Full – Banks have crafted the interest schemes on cards in ways that once you get into the cycle of paying interest it will take an enormous amount of will and effort to break the cycle. Learn how interest on credit cards work.

Buying things you don’t need or can’t afford – RFF is all about financial freedom and buying things you don’t need can derail your plans. Stay away from this habit.

If can’t resist buying stuff when you are in the shopping mall I recommend you follow Dave’s advice and shred your cards right away. My recommendation is not going to work for everyone. So be your own judge and decide what works for you.

I hope this guide helps clear the confusion about the benefits and pitfalls of using a credit card. Let me know your thoughts. criticism and feedback via comments.

Image Credit: Two Paddles Axe and Leatherwork on Unsplash

The post Don’t Cut Your Credit Card Before You Read This appeared first on One More Million.